Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The cost of Parkinson’s disease can vary, ranging from thousands to tens of thousands of dollars per year. Parkinson’s cost includes medication, doctor visits, therapy sessions, and additional expenses related to managing the symptoms.

This chronic condition requires ongoing medical care, which can be a significant financial burden for individuals and their families. Proper planning, insurance coverage, and support programs can help alleviate some of the costs associated with managing Parkinson’s disease. We will explore the various factors that contribute to the overall cost of Parkinson’s and provide some tips on managing these expenses more effectively.

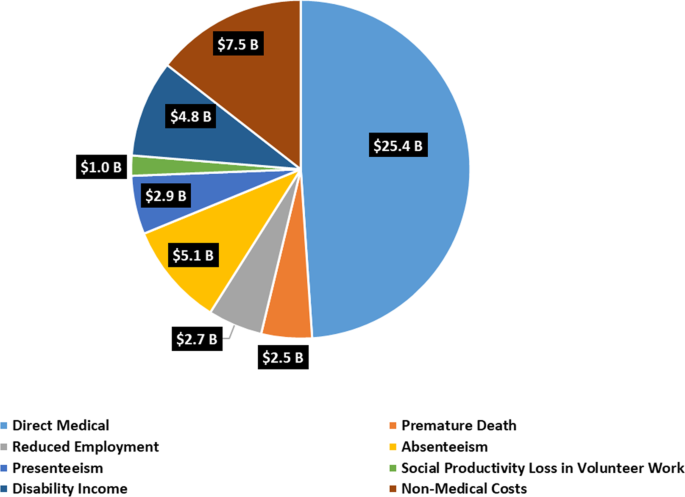

Parkinson’s disease has a significant economic impact due to costs associated with medical treatment, medications, and caregiving. These expenses can substantially affect individuals with Parkinson’s and their families, highlighting the need for effective management strategies.

During the course of Parkinson’s disease, individuals often face a substantial burden of medical expenses. These costs primarily encompass the treatment and management of the condition. Direct medical costs encompass a wide range of healthcare services, including consultations with doctors, medications, hospital visits, surgeries, and rehabilitation therapies. Individuals with Parkinson’s may require multiple consultations with healthcare professionals to monitor the progression of their condition and adjust treatment plans accordingly. They also rely on a variety of medications to help manage symptoms and improve their quality of life. In some cases, surgical interventions such as deep brain stimulation may be recommended as a last resort.

In addition to the direct medical costs associated with Parkinson’s disease, there are significant indirect costs and productivity losses that have far-reaching consequences. These expenses arise from the impact of the disease on an individual’s ability to work, the need for assistance with daily activities, and the potential strain it puts on caregivers. Parkinson’s disease often affects an individual’s ability to carry out their regular job duties, resulting in a loss of productivity and potential income. Employed individuals may require additional days off work to manage their condition or attend medical appointments.

Furthermore, as the disease progresses, individuals with Parkinson’s may become increasingly dependent on others for everyday activities. They may require assistance with tasks such as bathing, dressing, and meal preparation, which can lead to additional financial costs for home healthcare services or residential care facilities. Family members who assume the role of caregivers may also face productivity losses themselves, as they may need to reduce their working hours or leave their jobs entirely to provide the necessary care and support.

It is important to consider the economic impact of Parkinson’s disease as it not only affects individuals and their families but also has broader implications for healthcare systems and society as a whole. By understanding the financial burden associated with this condition, policymakers, healthcare providers, and individuals with Parkinson’s can work together to develop strategies and solutions to mitigate the economic challenges faced by those affected.

Credit: www.nature.com

When it comes to managing the financial burden of Parkinson’s disease, understanding health insurance coverage is essential. Having appropriate coverage can help alleviate the costs associated with this chronic condition. In this section, we will explore two common insurance options that many individuals with Parkinson’s rely on: Medicare and Medicaid, as well as private insurance alternatives.

Medicare and Medicaid are two government-sponsored insurance programs that play a crucial role in providing healthcare coverage to people with Parkinson’s disease.

Medicare:

Medicare is a federal health insurance program primarily available to individuals aged 65 and above. However, it also covers some younger individuals with disabilities, including those with Parkinson’s. Medicare consists of several parts, each covering different aspects of healthcare:

It’s important to note that while Medicare covers many Parkinson’s-related expenses, certain costs such as long-term care or custodial care may not be covered.

Medicaid:

Medicaid, on the other hand, is a joint federal and state program that provides healthcare coverage for individuals with limited income and resources. Eligibility for Medicaid varies across states, but if you qualify, the program can help cover a variety of Parkinson’s-related costs, including doctor visits, prescription medications, and long-term care services.

If you don’t qualify for Medicare or Medicaid or prefer private insurance options, there are various alternatives available:

Choosing the right private insurance option may require careful consideration of your individual needs, financial situation, and specific policy details. It’s advisable to compare plans, evaluate coverage levels, and assess out-of-pocket costs before making a decision.

Financial assistance programs can help alleviate the expenses associated with Parkinson’s disease, including medication, therapy, and specialized care, making it more manageable for individuals and their families.

Financial assistance programs offered by the government can provide much-needed support for individuals living with Parkinson’s disease. These programs aim to help alleviate the financial burden that comes with managing the various aspects of the condition. One such program is Medicare, a federal health insurance program primarily for individuals aged 65 and older, but also available for younger people with disabilities. Under Medicare, individuals with Parkinson’s can receive coverage for doctor visits, hospital stays, and prescribed medications.

Nonprofit organizations dedicated to assisting individuals with Parkinson’s disease also offer financial support through various programs. These organizations understand the challenges faced by patients and their families and strive to provide resources and financial aid to help navigate the costs associated with the condition. One such organization is the Parkinson’s Foundation, which offers grants and scholarships to help individuals access medical treatments, therapies, and support services. Additionally, the Michael J. Fox Foundation also provides financial assistance programs to help cover the costs of medical expenses not covered by insurance.

In summary, financial assistance programs provided by government entities and nonprofit organizations can be a valuable resource for individuals living with Parkinson’s disease. These programs aim to alleviate the financial burden and provide support in managing the costs associated with the condition. Whether it’s through Medicare coverage or grants from nonprofit organizations, these programs can help ensure that individuals can access necessary medical treatments, therapies, and support services without the added worry of financial strain.

Reducing the financial impact of Parkinson’s disease can be challenging, but with the right strategies, it is possible to alleviate some of the burden. Here are some tips for reducing Parkinson’s-related expenses that may help individuals and families manage the costs more effectively.

One effective way to reduce Parkinson’s-related expenses is by exploring the option of generic medications. Generic medications are often more affordable than brand-name drugs and can offer significant savings. Additionally, individuals with Parkinson’s may be eligible for prescription assistance programs offered by pharmaceutical companies, which can help lower the cost of their medications.

Accessing low-cost or free community resources can also make a substantial difference in managing Parkinson’s-related expenses. Many communities offer support groups, exercise classes, and counseling services specifically designed for individuals with Parkinson’s, and these services are often available at low or no cost.

Planning for long-term financial needs is crucial for individuals with Parkinson’s as it helps estimate the expenses incurred due to the disease. Proper financial planning ensures a secure future, allowing for the costs associated with medication, therapy, and other aspects of managing Parkinson’s.

Long-term financial planning is crucial for individuals with Parkinson’s disease and their families. The costs associated with managing the condition can be significant, necessitating careful consideration of financial strategies over time.

Engaging the expertise of financial advisors is a wise step in navigating the financial challenges of Parkinson’s. These professionals can provide tailored guidance on budgeting, investment opportunities, and long-term financial stability, enhancing the overall financial well-being and security.

As the condition progresses, individuals may need to explore retirement and savings options that align with their changing needs. This could involve maximizing retirement plans, considering long-term care insurance, and strategizing around healthcare costs to ensure financial security during retirement years.

By incorporating sound financial planning tailored to the unique challenges associated with Parkinson’s, individuals and their families can work towards maintaining financial stability, alleviating stress, and enhancing overall quality of life.

-1024x576.jpg)

Credit: neurotorium.org

Credit: parkinsonsnewstoday.com

The cost of medication for Parkinson’s can vary, but it is generally expensive. It depends on the specific drugs prescribed, insurance coverage, and discounts available. Considering these factors can help manage the cost and discuss options with healthcare providers.

On average, individuals with Parkinson’s live for 15 to 20 years after diagnosis. However, life expectancy varies depending on age, overall health, and the progression of the disease. Engaging in regular exercise and proper medical treatment can help improve quality of life and possibly increase lifespan.

Parkinson’s is not very common, affecting around 1% of people over 60. However, the risk increases with age.

No, you do not have to pay for Parkinson’s medication.

Parkinson’s disease can take a significant toll on both individuals and society, with costs spanning medical expenses, medication, and supportive care. Beyond the financial burden, it is crucial to consider the emotional and social costs endured by patients and their loved ones.

Raising awareness and implementing strategies to manage the costs of Parkinson’s can alleviate the strain and improve the overall quality of life for those affected by this debilitating condition.